FreeAgent is a UK-based accounting platform focused on small businesses. Acquired by The Natwest Group in 2018, I worked in the Banking Integrations team, exploring ways to use banking data to help engage and onboard Natwest customers.

Engagement and onboarding powered by Open Banking

Designed for

FreeAgent

Date

Q1 2021

Role

Product Designer

Impact

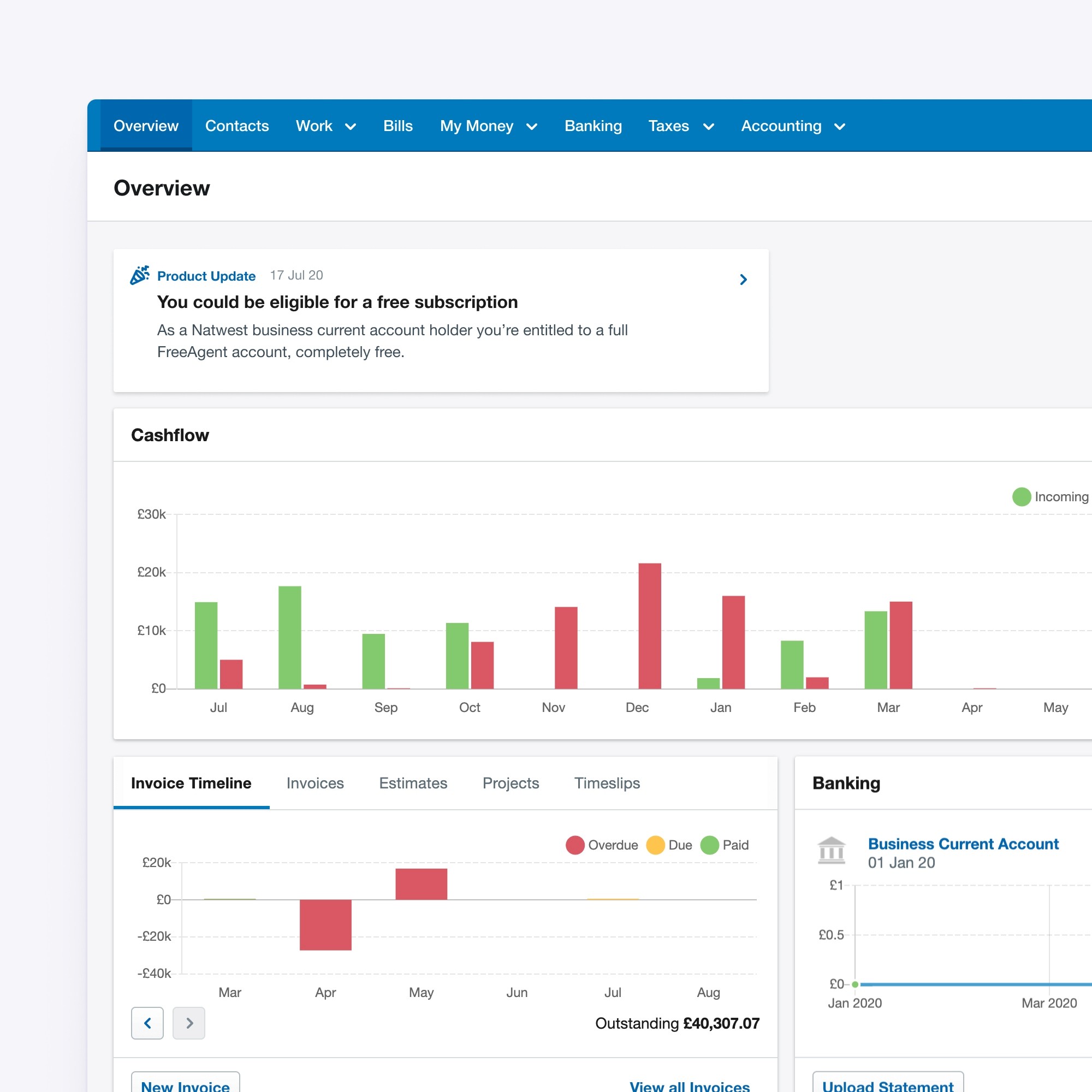

After Natwest's acquisition of FreeAgent, business banking customers were offered free FreeAgent accounts. With over 600,000 business customers (including RBS and Ulster Bank), this was a great opportunity to increase our active users and unlock more funding as a result.

Our team's work focused on acquiring new customers from Natwest's business banking apps with a target increase of 23%. Over several phased releases, we consistently hit a 70% increase compared to the same month from the previous year.

The problem

Despite a free FreeAgent account representing a great deal for small businesses, the team had been disappointed by the number of NatWest customers claiming their accounts.

Research suggested customers were either unaware of the deal, or reluctant to switch from existing solutions due to the perceived effort required.

Understanding existing journeys

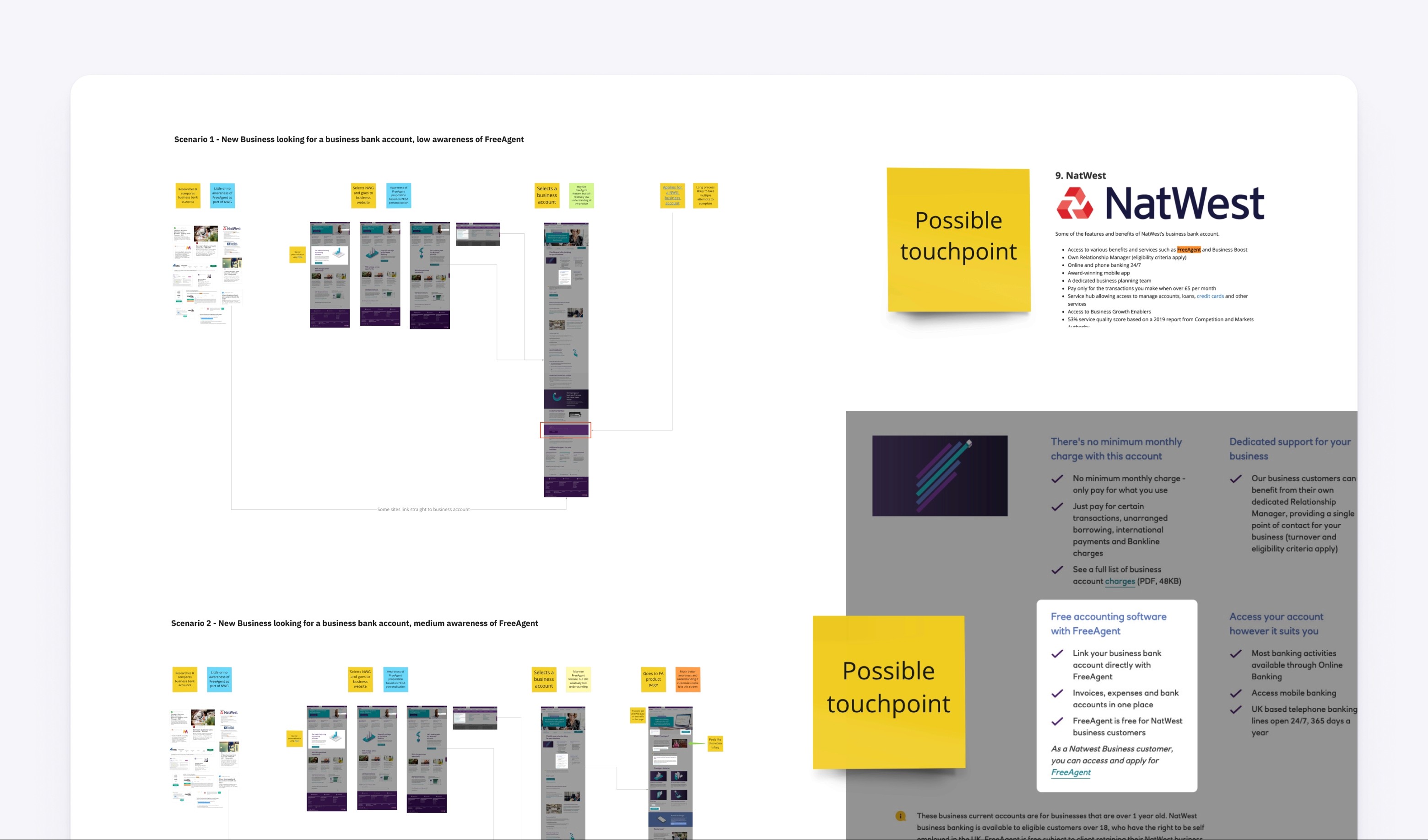

I wanted to understand the FreeAgent-focused marketing touchpoints customers were exposed to when applying for or using their NatWest account. So I audited all the possible journeys from entry points like comparison sites, information on apps and online banking platforms as well as any marketing collateral mentioning the free account.

I also asked the Natwest team for analytics data covering landing pages mentioning FreeAgent.

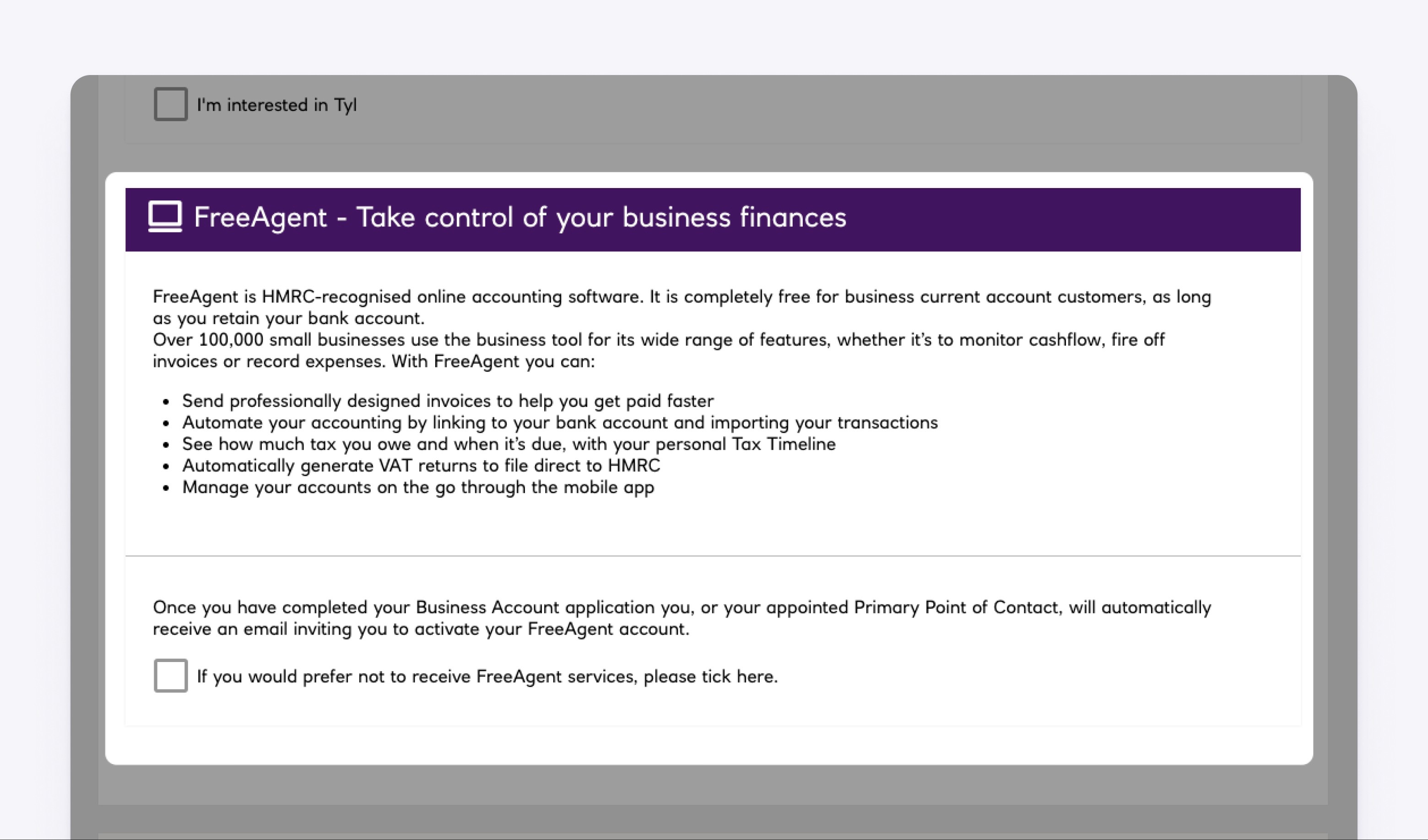

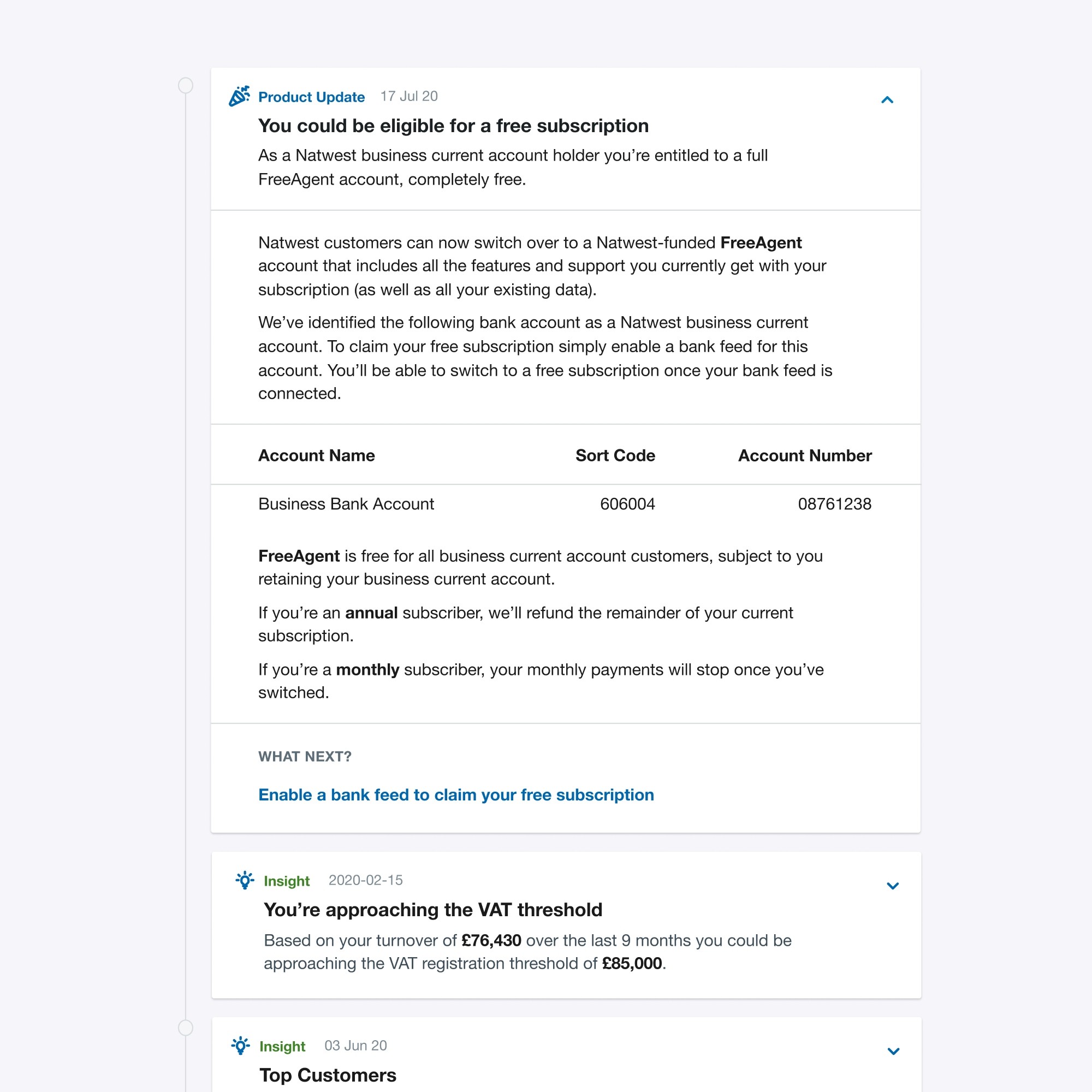

It became clear that the only touchpoint we could guarantee all new bank customers had seen was a service message on the 15th screen of their account application. For existing customers, most FreeAgent messaging was buried within the Apply section of banking platforms, amongst lots of other services.

New and existing customers were unlikely to notice FreeAgent messaging

A "service message" during the bank account application process

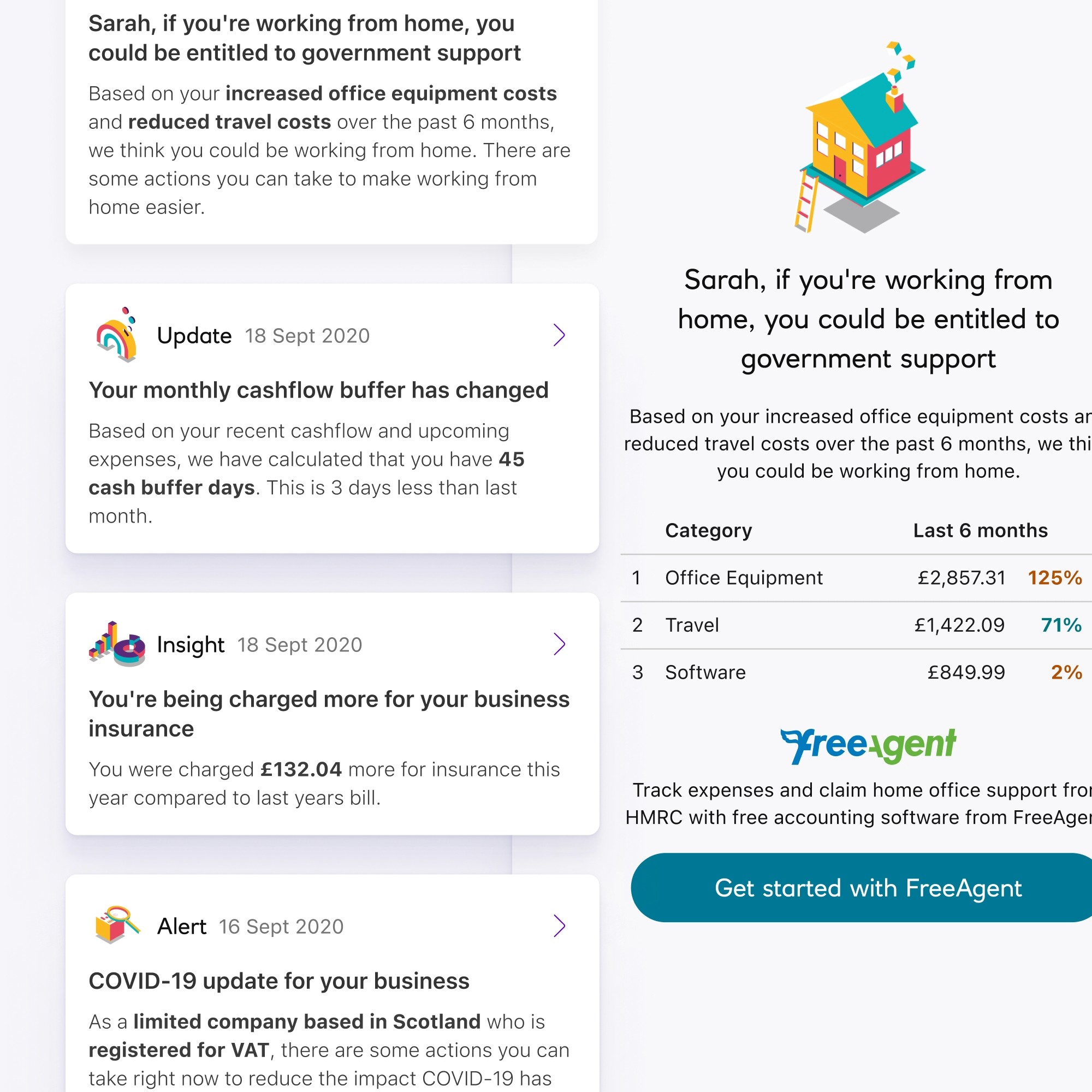

Embedding FreeAgent features within banking platforms

FreeAgent was targeted at "micro businesses" many of which used legacy accounting methods or relied on their accountant to do all of their bookkeeping. Our UX Research team had identified themes from interviews suggesting Natwest customers had a low understanding of FreeAgent features. We worked with the research team to ideate around how we could help solve the jobs banking customers might be trying to complete on banking platforms using FreeAgent features.

We hypothesised that bringing these features closer to banking customers would communicate the value proposition and create a nice engagement hook.

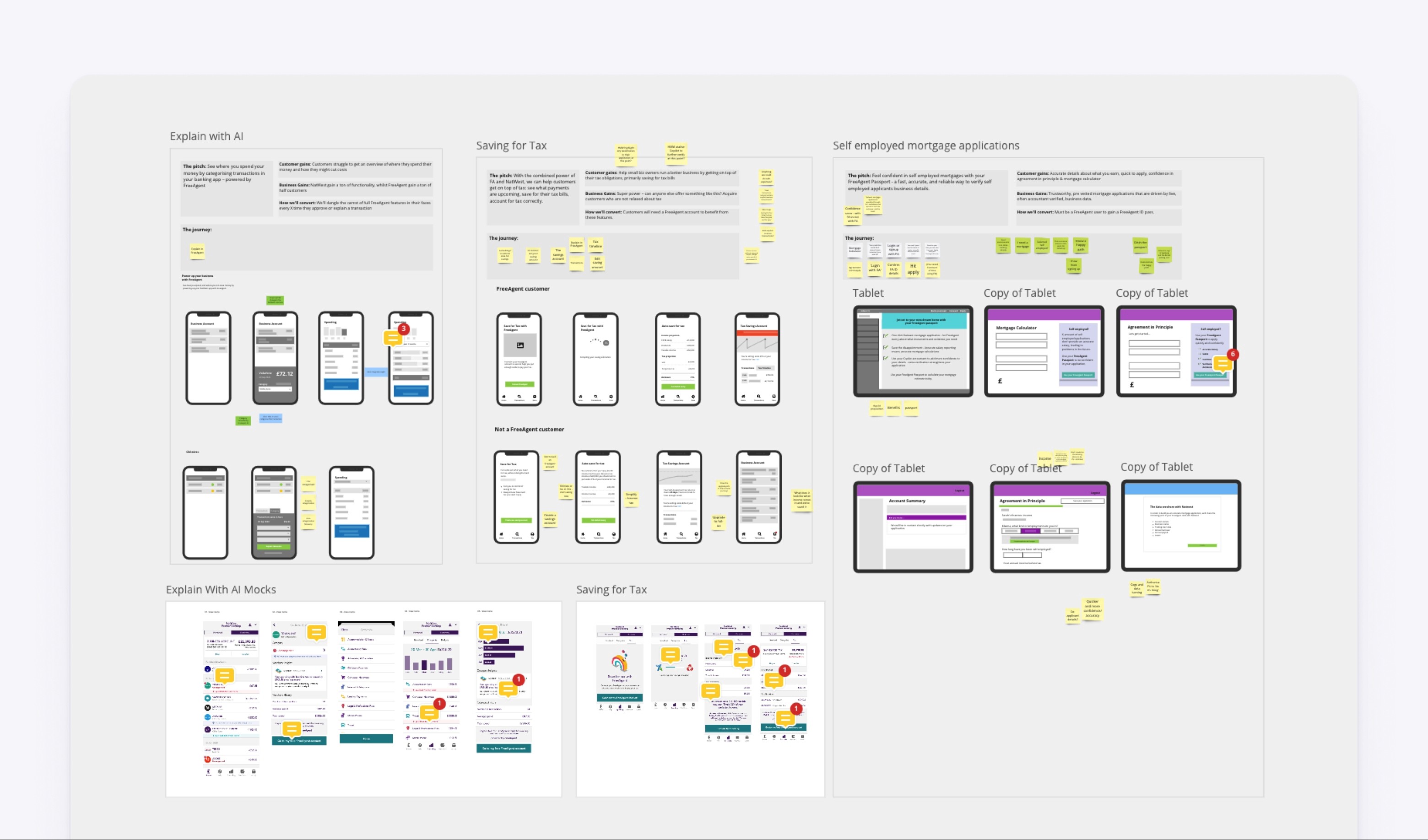

Typical Miro board showing early ideation of embedded FreeAgent features

Opportunities and challenges when using bank APIs

In 2019, FreeAgent had become the first UK accounting software to offer bank feeds via opening banking. However, for NatWest customers coming from their banking apps, the journey was still far from perfect: we had no way to match a FreeAgent account with Natwest account and no way to check if a FreeAgent account already existed for that business.

Improving this journey was a complicated technical exercise which required grabbing small, phased opportunities rather than expecting immediate transformations (or pretty UI design).

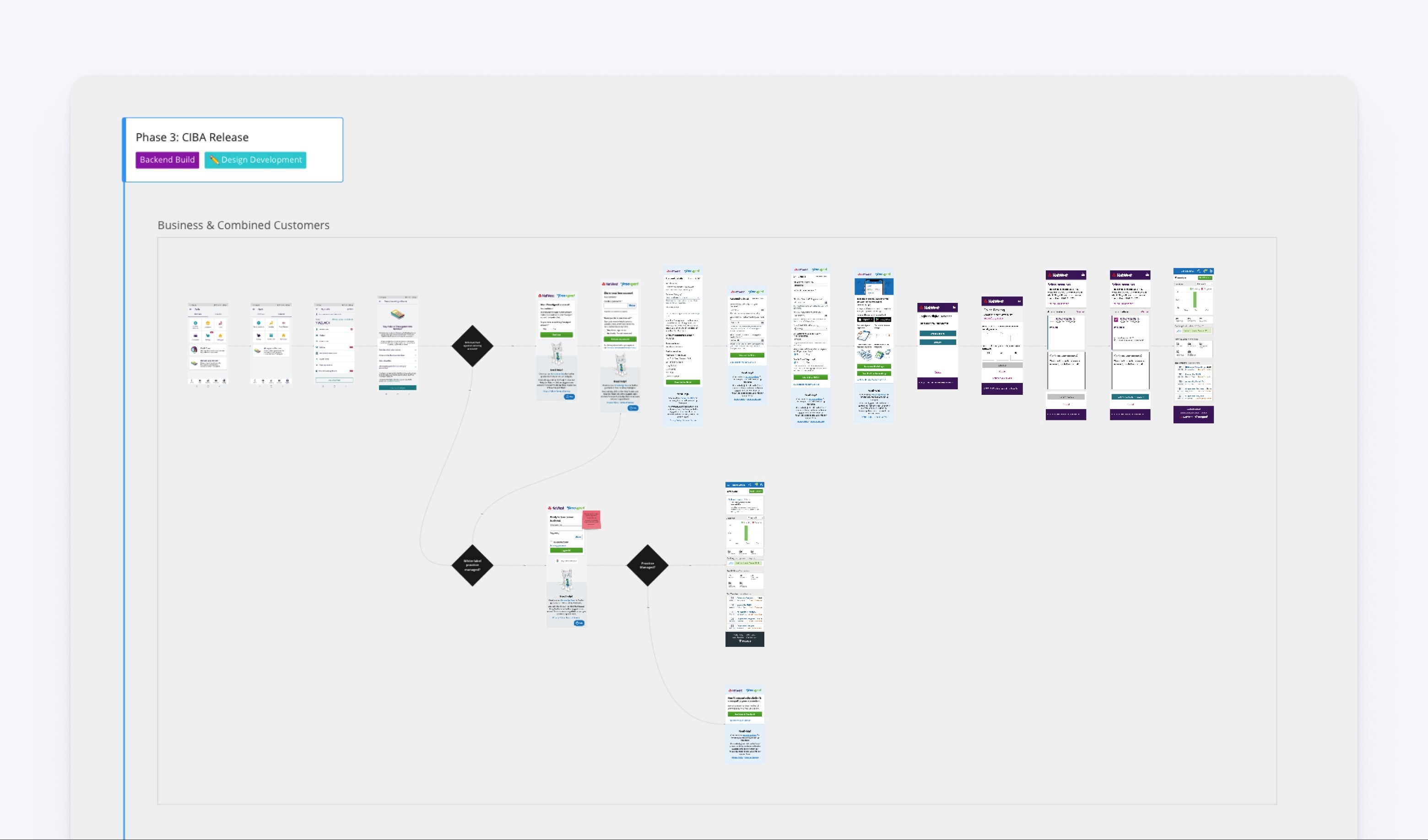

An example of how I documented phased updated to the sign up flow

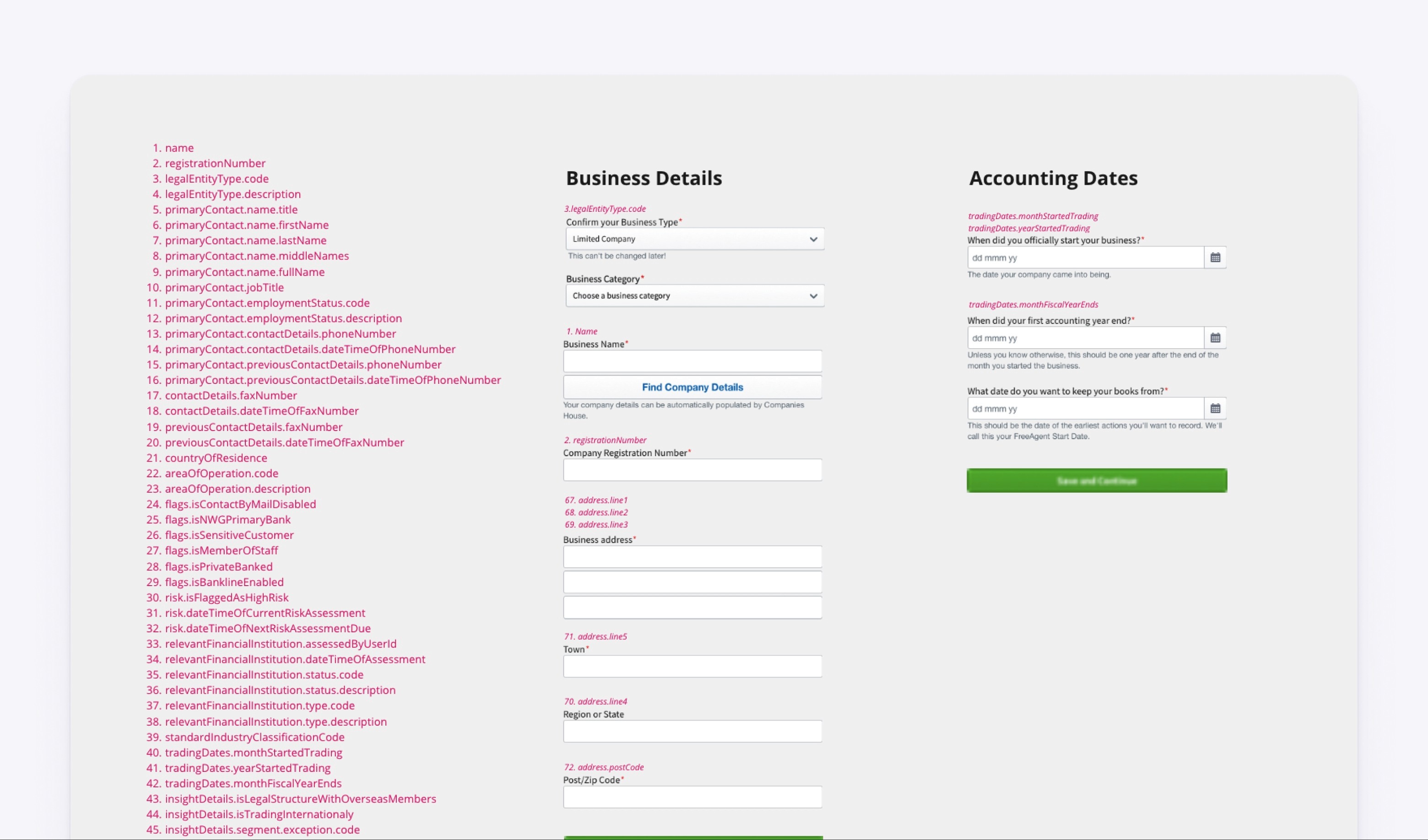

As well as the Open Banking API which provided us with transactional data; the bank had a large Customer API which gave us opportunities to skip steps in our sign-up journey. I began mapping endpoints to our sign-up forms to see where we could avoid asking customers for data they had already provided to the bank.

Mapping Customer API endpoints to our sign up forms

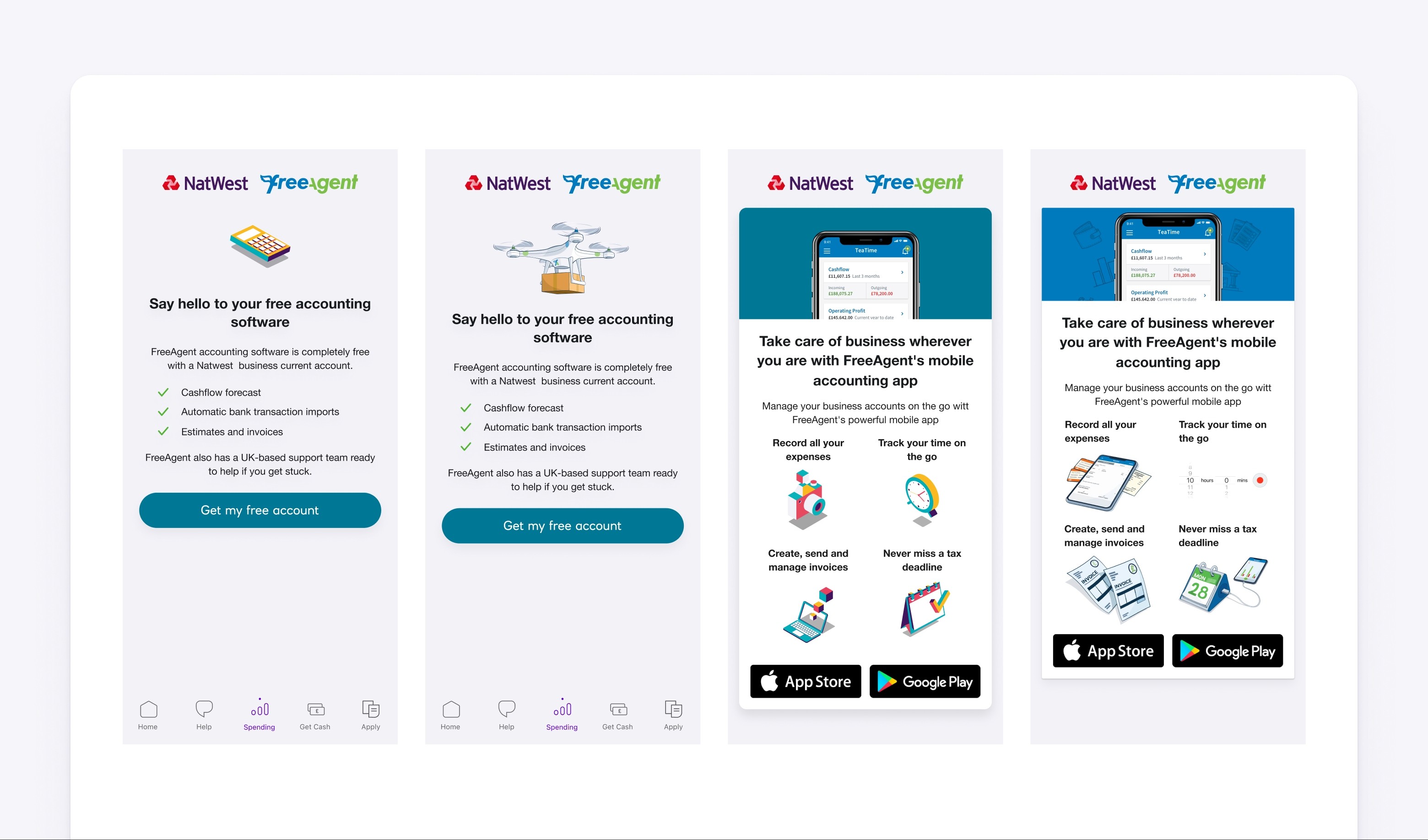

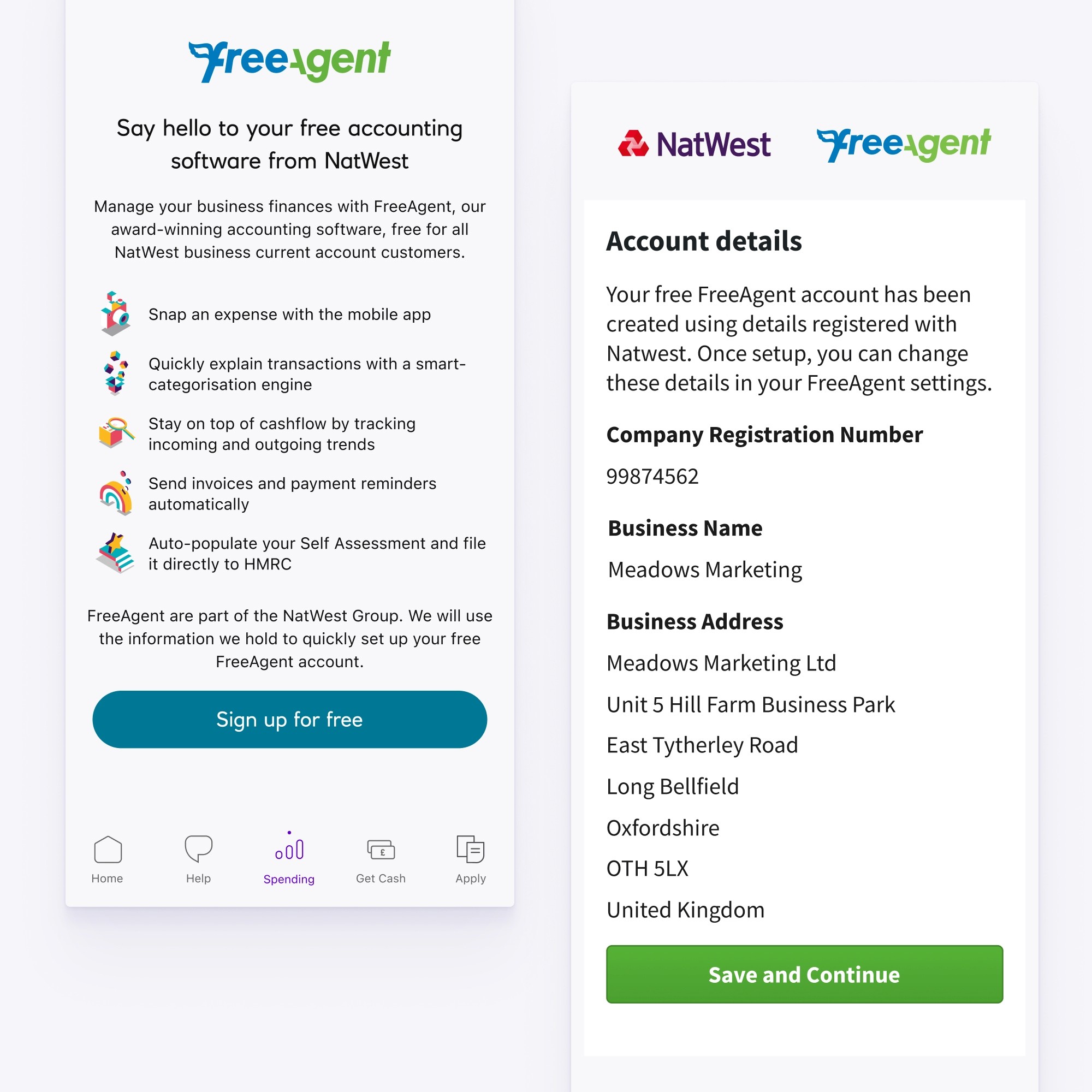

Working with the NatWest design system

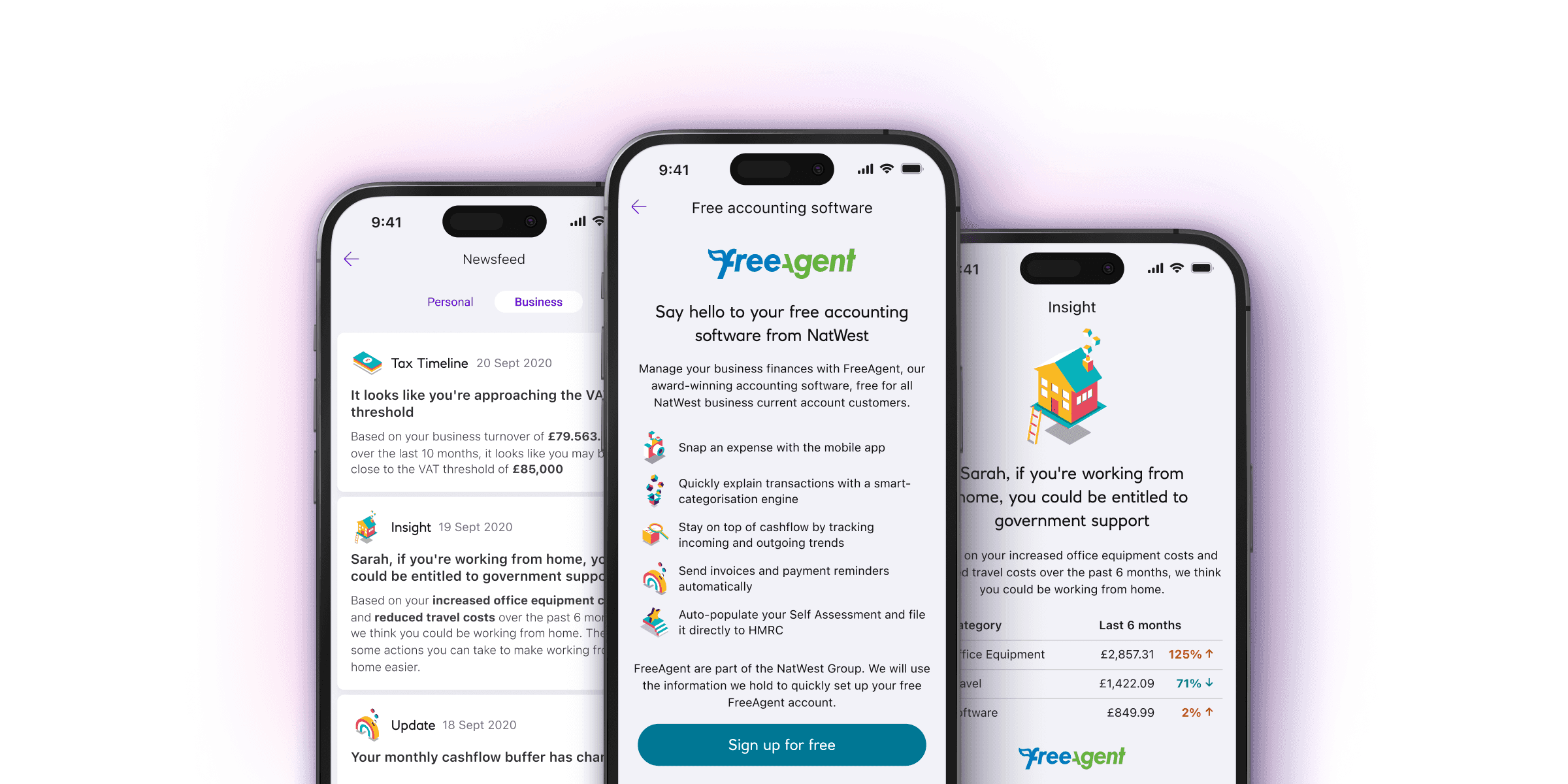

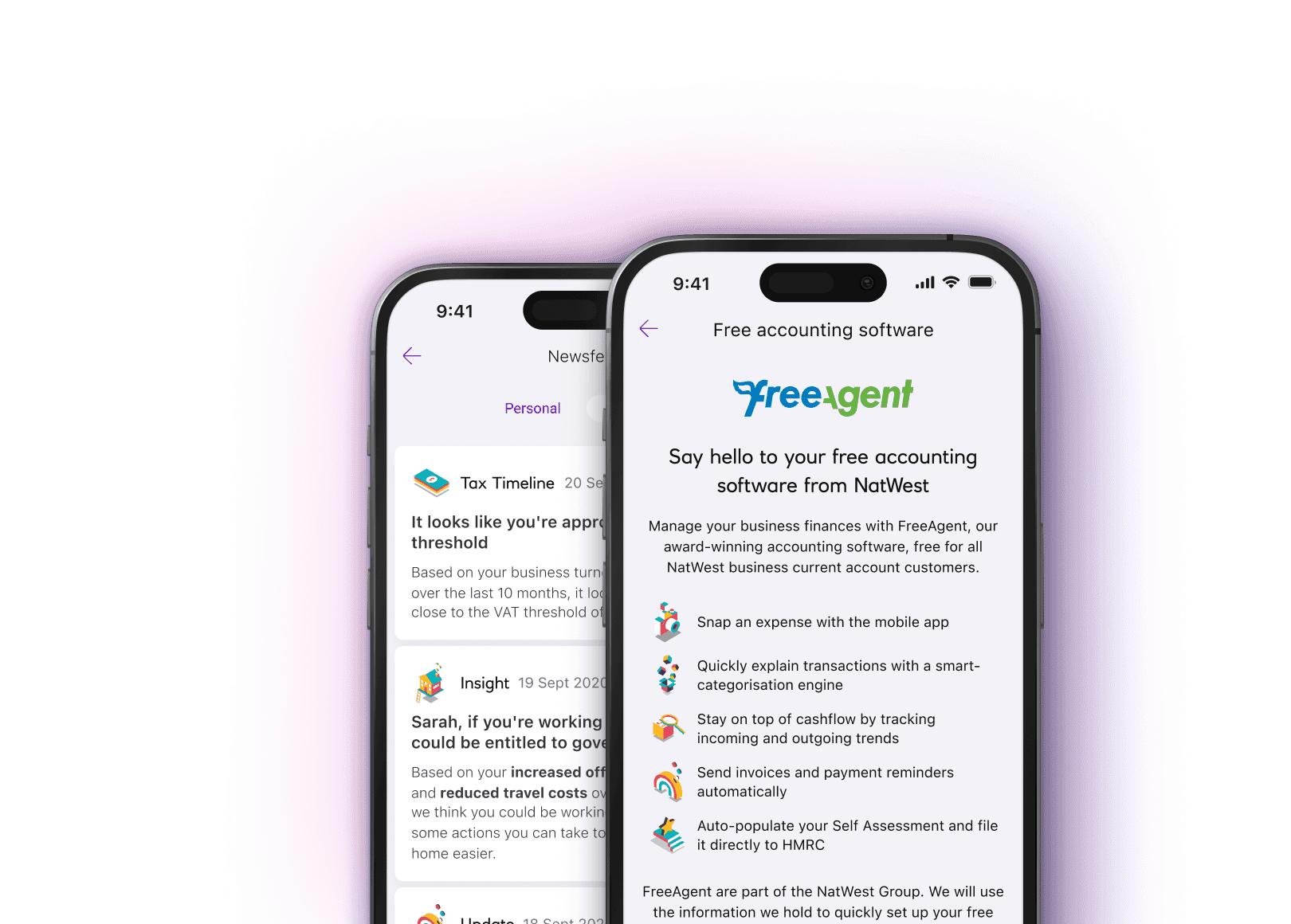

One of the difficulties with integrating FreeAgent into the Natwest estate was that the brands were completely different. Attempts to unify the brands tended to result in the perception of third-party partners rather than being part of the same business. I collaborated with both the NatWest and FreeAgent mobile design teams to create journeys that transitioned rather than jumped between platforms.

Iterations designed with NatWest and FreeAgent mobile teams

Outcomes and tradeoffs

Working with engineers in the banking integrations team taught me about the huge technical obstacles that can stand in the way of what seemed like the tiniest of UI updates. Despite this, by understanding how to prioritise iterative improvements and grasp opportunities, we had a big impact on the number of NatWest customers claiming FreeAgent accounts.